Would you like the certainty of an income stream guaranteed for life with the ability to leave money to your heirs or charity? If so, then an insured annuity strategy may be right for you.

The insured annuity construct can preserve the value of your estate, minimize income taxes and most importantly, guarantee you an income for life. It involves the purchase of two contracts: a permanent life insurance policy and a prescribed life annuity.

Using your non-registered capital to purchase a life annuity will produce a higher income than typical fixed income investments and ensures a guaranteed income that you can’t outlive. Each income payment from a life annuity is a blend of interest and your original capital, where only the interest portion is taxable. When you die the annuity payments stop and the life insurance benefit is paid to your beneficiaries.

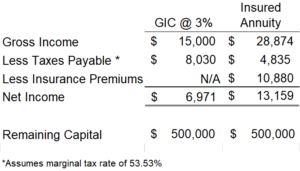

Because of the special tax treatment afforded by the annuity, the after-tax return on the Insured annuity concept may be significantly greater than can be found on conventional interest-bearing investments like GICs.

Example

This example shows how a 65-year-old couple with $500,000 of non-registered assets who wants lifetime income and to leave that capital amount to their heirs, can almost double their after-tax income by using the insured annuity strategy versus a GIC:

Consult your Foster advisor to see whether an insurance annuity strategy may be right for you!

Disclaimer: This article is for general information purposes only, and is not legal, financial, or tax planning advice. Everyone’s situation is unique, and this article cannot apply to every person. The reader should not take any action, or refrain from taking any action, as a result of this article without first obtaining legal or professional advice.